Choosing Between Free and Paid Business Valuations: A Complete Guide#

In today's dynamic economic landscape, understanding the true value of a business is crucial for both buyers and sellers. Whether you're considering buying a business, selling a business, or involved in mergers and acquisitions (M&A), business valuation is an indispensable tool. However, one of the pivotal decisions you need to make is whether to opt for a free business valuation or invest in a paid one. This guide aims to help financial advisors, small business owners, and other stakeholders navigate this crucial decision-making process.

Table of Contents#

What is Business Valuation?

Why Business Valuation Matters

Free Business Valuations

Pros of Free Business Valuations

Cons of Free Business Valuations

Paid Business Valuations

Pros of Paid Business Valuations

Cons of Paid Business Valuations

Free vs Paid Business Valuations: Which to Choose?

When to Choose a Free Business Valuation

When to Opt for a Paid Business Valuation

Conclusion

What is Business Valuation?#

Business valuation is the process of determining the economic value of a business or company unit. It is essential for various reasons, including business acquisition, mergers and acquisitions (M&A), and selling a business. A business valuation tool can help assess the worth of your business based on several factors, including market conditions, financial performance, and competitive landscape.

Why Business Valuation Matters#

For sellers, a business valuation provides insights into the potential market price of the business, helping set realistic expectations and a fair asking price. For buyers, it offers a detailed understanding of what they are investing in, helping them make informed decisions. Moreover, business valuations are crucial during M&A activities to ensure that all parties have a clear understanding of the business's worth.

Free Business Valuations#

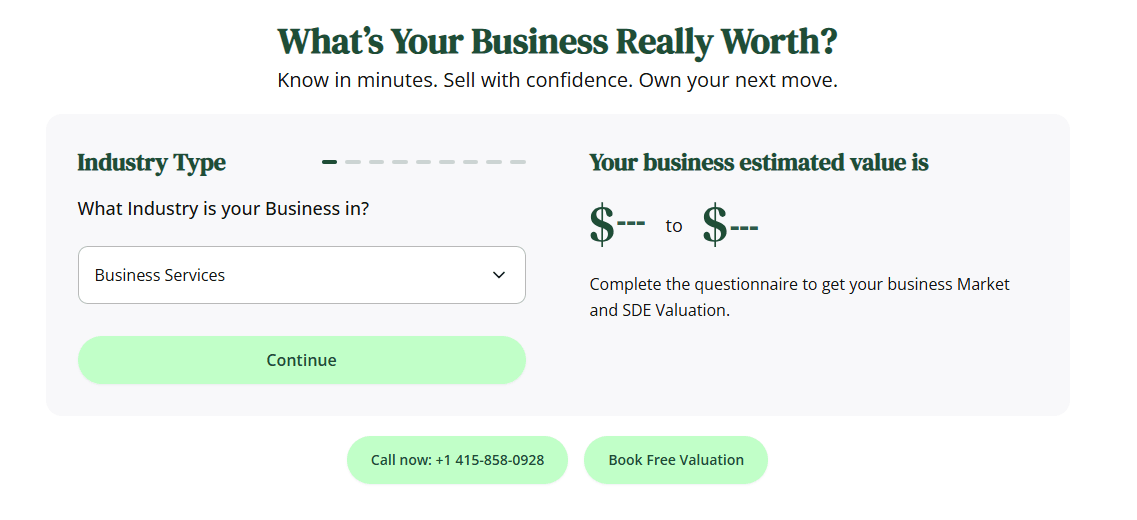

Free business valuations are typically offered by online platforms like the Openfair Business Valuation Tool BVT and are often seen as an attractive option due to their accessibility and zero cost. However, there are pros and cons to consider.

Pros of Free Business Valuations#

Cost-Effective: The most apparent advantage is that they are free of charge. This can be particularly appealing for small business owners or individuals who are in the early stages of buying a business or selling a business.

Quick and Easy: Free tools often provide quick results, making them convenient for those who need a fast assessment.

Cons of Free Business Valuations#

Limited Accuracy: Free tools may not offer the depth of analysis needed for complex transactions. They often rely on generic algorithms that may not consider specific market dynamics or unique business characteristics.

Lack of Customization: These tools typically offer a one-size-fits-all approach, which might not cater to the unique needs of every business.

No Expert Guidance: Free valuations do not come with professional advice or insights that can help interpret the results.

Paid Business Valuations#

Paid business valuations are conducted by professional appraisers or financial experts and are often more comprehensive. Openfair offers a paid professional valuation free of charge as part of all its plans.

Pros of Paid Business Valuations#

Accuracy and Detail: Paid valuations are generally more precise, incorporating a thorough analysis of financial statements, market conditions, and future projections.

Expert Insights: They provide access to professional advice, helping you understand the nuances of the valuation and what it means for your business strategy.

Customized Approach: Paid services tailor their analysis to your specific business context, offering a more relevant and accurate valuation.

Cons of Paid Business Valuations#

Cost: The most significant downside is the cost, which can be a barrier for small businesses or those with limited budgets.

Time-Consuming: These valuations can take longer to complete due to their detailed nature.

Free vs Paid Business Valuations: Which to Choose?#

When deciding between free and paid business valuations, consider your specific needs and circumstances.

When to Choose a Free Business Valuation#

Preliminary Assessment: If you're at the initial stages of buying or selling a business and need a rough estimate.

Budget Constraints: When cost is a primary concern, and a detailed analysis is not immediately necessary.

When to Opt for a Paid Business Valuation#

Complex Transactions: For intricate M&A deals or when the stakes are high, the precision of a paid valuation is invaluable.

Strategic Decision-Making: When the valuation will significantly impact business strategy or negotiations, the detailed insights from a paid valuation are crucial.

Conclusion#

Choosing between free and paid business valuations depends on various factors including the complexity of the transaction, budget considerations, and the level of detail required. Both options have their merits, and understanding when and how to use each can significantly impact your financial and strategic outcomes.

By making an informed choice between free and paid valuations, businesses can better position themselves in the market, ensuring they make strategic decisions that align with their financial goals.